Government keen to reduce rates on Provident Fund

Rather than raise the interest on PPF (7.9%) to the level of PF(8.8%), the Government appears more keen to reduce the rates of PF

Although there are 10.38 crore senior citizens in the country who constitute 8.6% of the population, there are only 1.61 lakh Senior Citizens’ Savings Scheme accounts operating in banks.

The Government’s clear decision to link the interest rates to the market and to review the rates every quarter instead of annually, are acting as a disincentive for people to invest in small saving schemes like National Saving Certificate, Kisan Vikas Patra etc.

Ironically, though the Senior Citizens Savings Schemes draw 8.4% interest, it is still lower than Provident Fund contribution by people working in the organised sector.

Changes in interest rates on various small savings schemes

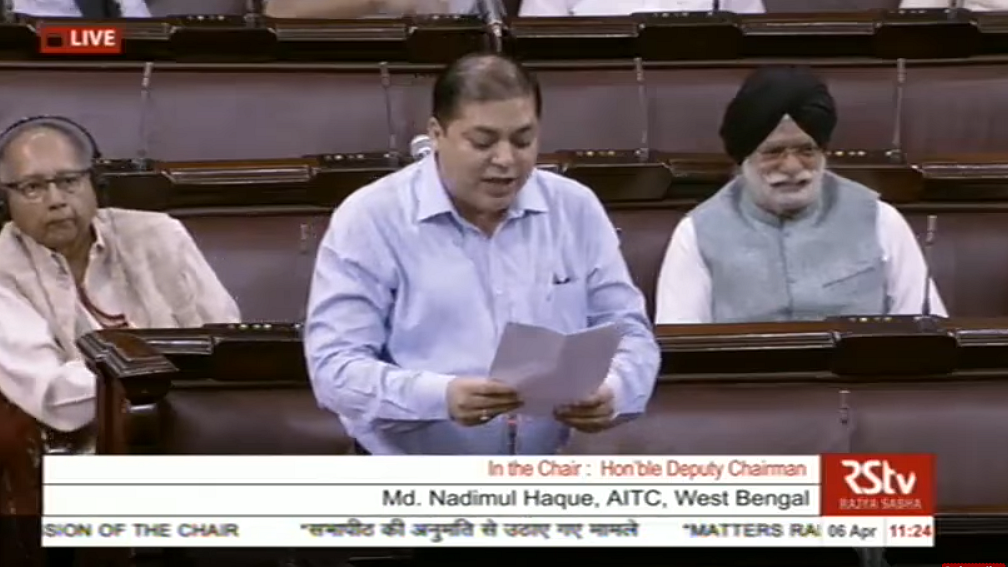

Objecting to the reduction last week in the interest rates allowed on small savings, Rajya Sabha Member Nadimul Haque urged the Government to review the decision.

India’s greying population, he maintained, needed social security and the Government must encourage small savings. But paradoxically the Government has allowed 8.8% interest on Provident Fund contributions of those who work in the Government or in the organised sector but reduced the interest rate on Public Provident Fund (PPF) to 7.9% from April this year.

While there is no bar on PF contributors to also have PPF accounts, those who are retired and senior citizens depend on interest they earn on their small savings, it has been pointed out.

The PPF now attracts the lowest interest in 40 years. The lower interest rates on small savings (just 4% on Post Office Savings Accounts) are driving people to invest in the volatile stock market and run higher risks.

While the issue was raised during Zero Hour in the Rajya Sabha, there was no response from the Government to the plea.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines