Demonetisation effect: Currency designed with eyes closed

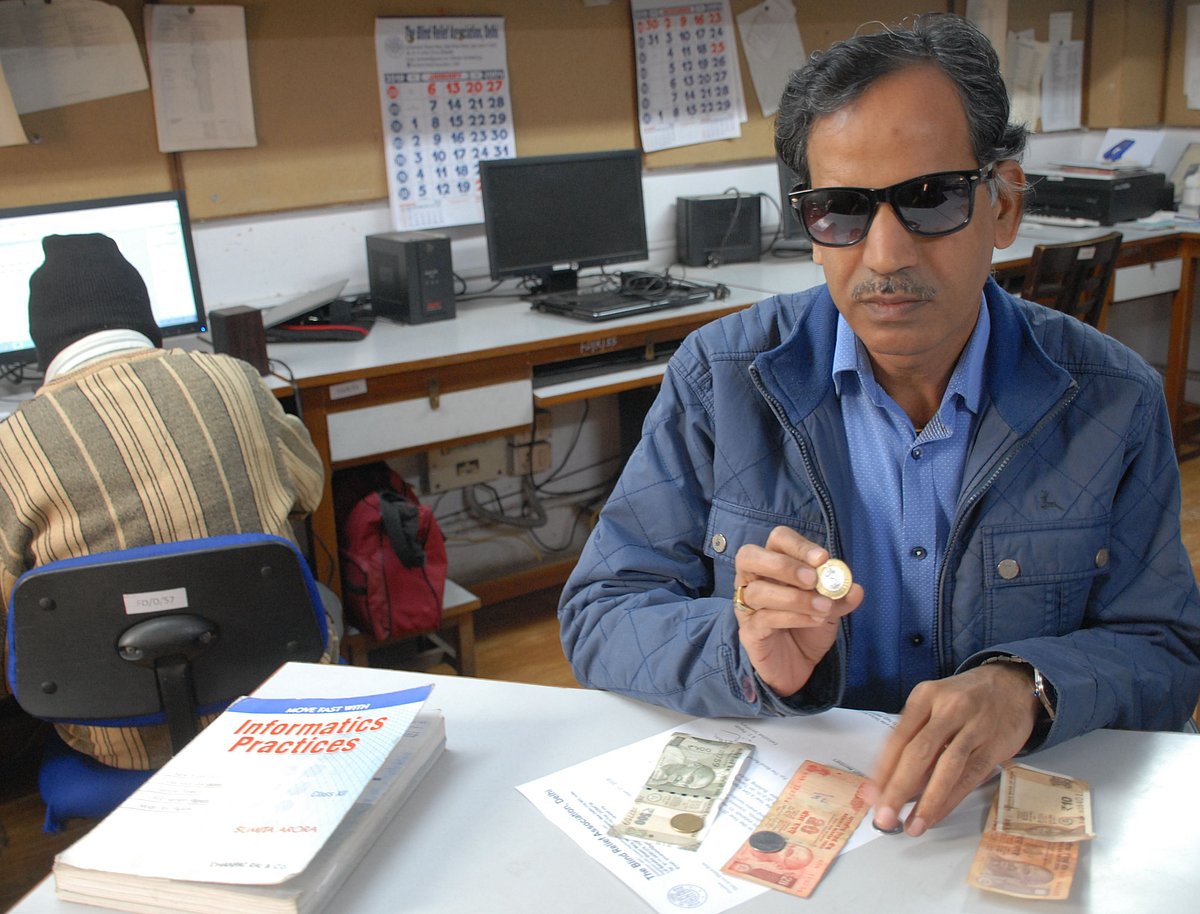

The new banknotes and coins introduced post demonetisation are proving to be visually impaired unfriendly

An online petition to Finance Minister Arun Jaitley, Prime Minister Narendra Modi, Department of Empowerment of Persons with Disabilities, Ministry of Social Justice and Empowerment and the Reserve Bank of India (RBI) on change.org raises the following pointed questions:

- How will you feel if you unknowingly give away a Rs 500 note to the autorickshaw driver instead of Rs 20 note and realise the mistake after he drives away?

- How will you live if, in every monetary transaction, there is no way for you to identify the notes, coins and total amount?

- How will you feel if every time you want to spend or get cash, you have to rely on another person to know the amount?

“Frightening and disabling, isn’t it?”: it replies with a question, adding, “Unfortunately, the above scenario is becoming a day-to-day challenge for over 50 lakh blind people in India and millions of senior citizens with low eyesight.”

“This is a problem we, the blind people of India, have been facing since the 90’s when different sizes of Rs-two coins were introduced,” says Amiyo Biswas, a senior member of the Blind Persons’ Association, Kolkata. He adds, “Now, the mints seem to have gone mad. They are pouring out something new every now and then. We identify coins by their sizes and surfaces, even weight. But there is more than one variety of every coin and they are hardly distinguishable.”

The central bank has been introducing new-look notes in the denominations of Rs 10, 50, 100, 200, 500 and 2,000 since November, 2016. These are different in sizes as compared to the old ones.

“They are difficult to recognise. We distinguish notes by measuring by touch their length and width. The bigger the size is, the greater denomination it has,” Biswas says, lamenting, “But the new Rs 500 and Rs 2,000 notes are smaller than old notes of lower denominations like the Rs 100 note. The introduction of new Rs 200 and Rs 50 notes has posed a more serious challenge because like coins, notes of two different sizes are in circulation for these two denominations.”

“We have given several written representations to the authorities concerned followed by repeated reminders but to no avail,” Biswas complains.

Even though the RBI has started introducing bleed lines or tactile markings in the new currency notes for visually impaired persons, the new feature seems to have failed in serving the desired purpose. Talk to any random visually impaired person, they will tell you that the new currency notes get worn out very soon, making it impossible for them to identify a banknote by touch of hand.

However, what has made matters worse for the blind people is the RBI’s decision to remove intaglio from certain notes. Invoking Article 16 that seeks to confer equality of opportunity in the matter of public employment and the Right of the Persons with Disability Act 2016, many organisations working for the welfare of the visually impaired have moved high courts under Article 226 of the Constitution.

Advocate Saurabh Banerjee has filed a writ petition on behalf of All India Confederation of the Blind in Delhi High Court. He stresses that there should be at least 10 mm difference in the length and width of two notes. “This was always practised which made the Indian Rupee one of the most accessible currencies in the world,” he says.

He adds, “The new coins don’t bear any tactile marking or any other identification features. They are almost of the same size and shape. The imprint vanishes very soon once a coin comes into circulation.”

But RBI claims, in keeping with the special needs of the visually impaired, the new banknotes have intaglio or raised printings of Mahatma Gandhi portrait, Ashoka Pillar emblem and angular bleed lines on the left and the right side of the notes with identification marks in raised prints. They say Rs 50, 100, 500 and 2000 notes carry three bleed lines in a single block, 4 lines in two blocks, 5 lines in three blocks and seven lines in five blocks respectively.

Those campaigning for accessible currency and banking facilities to the visually, however, contest that “the bleed lines on polymer notes are perceptible, not on paper notes.”

Advocate Banerjee also refutes the RBI’s claims. He asserts that the embossing on currency notes can’t be felt by the visually impaired with their hands.

During last hearing, the RBI told the Delhi High Court that it was in touch with a mobile App developer, who has developed an App specifically for the identification of notes by the visually impaired.

However, JL Kaul, secretary general of All India Confederation of the Blind, feels that the mobile Apps and even brail for that matter, can’t be an answer to their problems claiming that the blind in the rural areas continue to be illiterate or have limited access to digital technologies.

Another petition over the issue has been filed in the Bombay High Court. Executive director of National Association for the Blind (NAB), Mumbai, Pallavi Kadam, tells National Herald, that the Bombay High Court had sought reply from the RBI, asking as to why the blind can’t identify notes and coins of recent years, in early December 2016. However, she added that the central bank hasn’t filed its response to the court as yet.

“There have been over 10 hearings but the matter hardly comes up in the court on the scheduled date for paucity of time,” she says, stressing that “hearing of such sensitive matters should be held on a priority basis.”

Kaul decries the way the new banknotes have disempowered people with visual impairment: “The purpose of new government policies should be to empower people. But the new ‘inaccessible currency’ has made the visually impaired entrepreneurs dependent again.”

The cost of printing currency notes increased to Rs 7,965 crore in 2016-17, the government informed Parliament recently. But the organisations working for the blind people argue that the cost of lost livelihoods, risk of jobs generated by blind entrepreneurs and their independence is economically and socially much higher than the cost of the government withdrawing inaccessible notes and coins.

In addition to this, blind people have also been debarred from ATM services besides net banking or mobile banking as the Apps and websites don’t cater to their special needs. While few visually impaired persons have bank accounts and fewer have cheque facilities and debit cards, digital currency remains totally inaccessible for them.

It has also been a longstanding grievance of the people with visual impairment that hard-pressed bank officials usually don’t cooperate with them. They complain that if SIM card dealers can verify fingerprints of customers with the national database of UIDAI (Unique Identification Authority of India) for Aadhaar cards, why can’t the bankers use the same to verify the thumb impressions of visually challenged customers.

Additionally, the online petition talks about the denial of economic justice and stresses upon the government to take into consideration all their problems related to financial transactions and banking services. “All modes of monetary transactions – notes, coins, ATMs, websites and Apps be made accessible for all persons with disabilities including the blind,” the petition stresses before maintaining that “This will empower the blind, illiterates and senior citizens and save us from being cheated, make us feel safer, enable us to live independently and with dignity.”

“We must know what we earn and spend. This is a right we deserve,” remarks Biswas, requesting the authorities concerned to be a little more sensitive towards the special needs of the visually impaired people.

What the RBI has to say

The counter affidavit filed by the RBI in the Delhi High Court dated February 16, 2018, maintains that “all the prayers made by the visually impaired people are liable to be rejected”. Claiming that the plea is devoid of the “merit”, it asserts that “the petitioners are not entitled to any relief against the respondent and the petition deserves to be dismissed with costs.”

Here’re the major takeaways from the RBI’s reply:

• Petitioners have failed to show any instances wherein visually impaired persons have faced difficulty in recognising new bank notes.

• All matters relating to denomination, composition, size and design of coins are exclusive ambit of Government of India under the provision of Coinage Act 2011. RBI’s role is limited to put into circulation the coins made available to it by the Centre.

• RBI is the sole note issuing authority for the banknotes in India. But, design, form and material of banknotes is approved by the Centre on recommendations of the RBI Board. The decision is taken by the Centre.

• None of the sections of the RBI Act stipulate any specifications from the viewpoint of the visually impaired.

• The petitioner has not come out with any irrefutable instance to show that the new notes have prejudiced the provisions of Section 3(1) of the Rights of the Persons with Disability Act 2016 that says: “The appropriate government shall ensure that the persons with disabilities enjoy the right to equality, life with dignity, and respect for his or her integrity equally with others.”

• As size is one of the decisive features used to identify denomination of bank note by a totally blind person, the same has been taken into account.

• The decision to remove intaglio from notes of small denominations such as Rs 50 was taken by the Centre upon recommendations of the RBI Board. In lower denominations, size is decisive feature. Reliance on intaglio identification marks is limited. The intaglio identification marks are not very tactile and become unidentifiable with soiling of the banknotes. Intaglio printing of banknotes increases cost of printing

• RBI was guided by feedback from Xavier’s Resource Centre for the Visually Challenged, Mumbai; Blind Peoples’ Association, Ahmedabad; National Association for the Blind, Mumbai; National Institute for the Visually Handicapped, Dehradun.

• There could be some similarity in dimensions of old Rs 50 and new Rs 200 notes. However, as old notes are withdrawn from time to time, the problem is transitory.

• The notes in the new series have been introduced in reduced sizes to minimise the costs of printing and aligning dimensions of Indian banknotes with international norms.

• The contention of the petitioner that the visually impaired are facing continuous hardship is a generalised, vague and unfounded statement.

• Introduction of an entirely innovative feature like bleed lines is culmination of thoughtful deliberation with all concerned including the associations for the visually handicapped.

• No feature of a banknote can be foolproof or ideal. Further, there is limitation of space in accommodating various features.

• While considering different features to suit the visually impaired, essential security features of banknotes can’t be compromised. To ensure the same, discretion is available to RBI.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

- demonetisation

- Reserve Bank of India

- Ministry of Social Justice and Empowerment

- Finance Minister Arun Jaitley

- PM Narendra Modi

- All India Confederation of the Blind

- National Association for the Blind

- The Blind Relief Association

- Blind Persons’ Association Kolkata