SBI refuses to share data on electoral bonds under RTI Act, says it will ‘disproportionately divert resources’

Electoral bonds are sold in limited branches of SBI and only for 10 days every quarter, with every branch likely to be maintaining details of bonds sold or enchased per day

The State Bank of India, the only bank authorised to issue electoral bonds, has denied date-wise details of electoral bonds sold or purchased during the 17th phase sale during July 2021 by stating that this data is not readily available with it.

Responding to an application filed under the Right to Information Act by RTI activist Kanhaiya Kumar, the SBI cited Section 7(9) of the RTI Act, claiming that the collection and collation of the information sought by him from its branches all over India would "disproportionately divert its resources".

Section 7(9) of the RTI Act, 2005, states that an information shall ordinarily be provided in the form in which it is sought unless it would disproportionately divert the resources of the public authority or would be detrimental to the safety or preservation of the record in question.

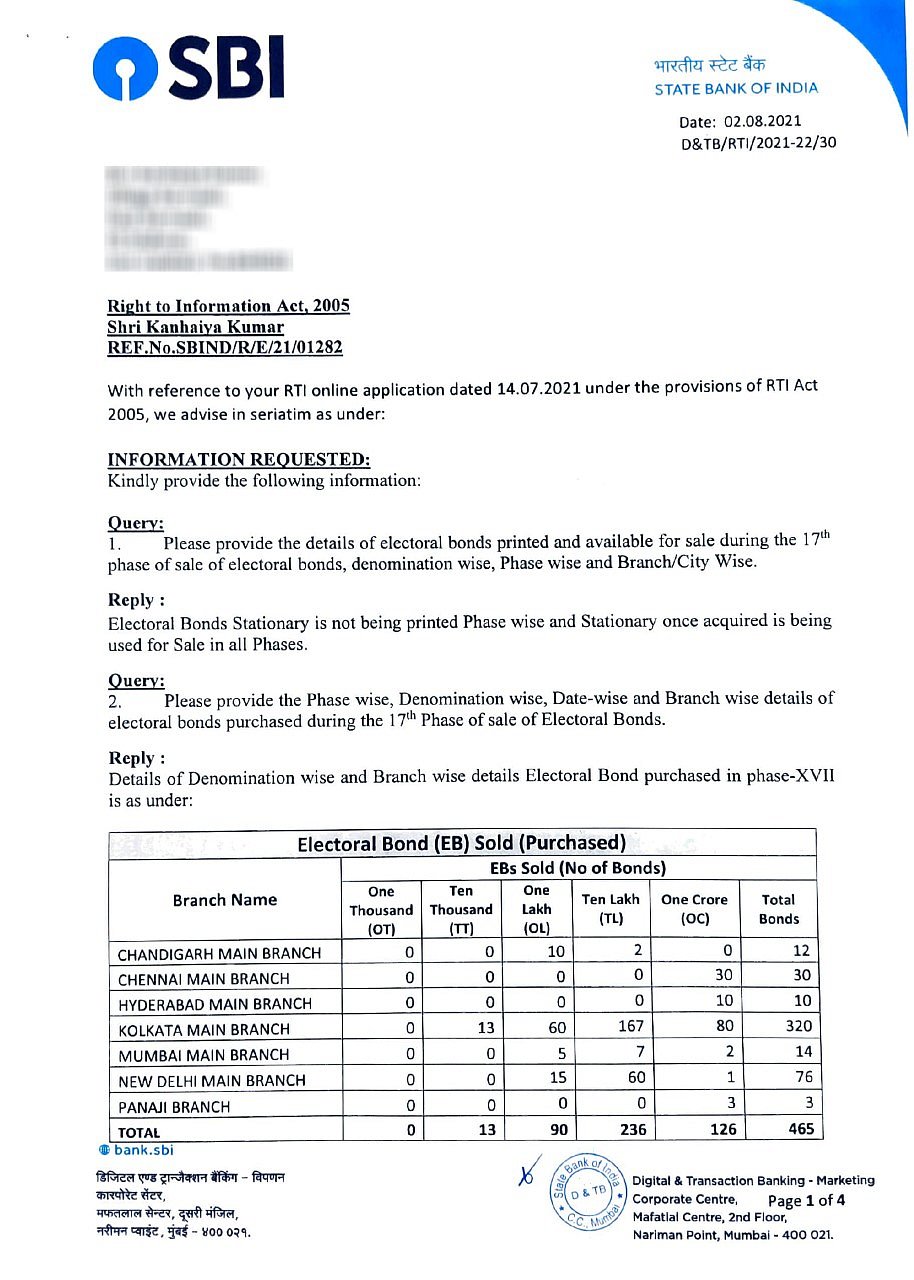

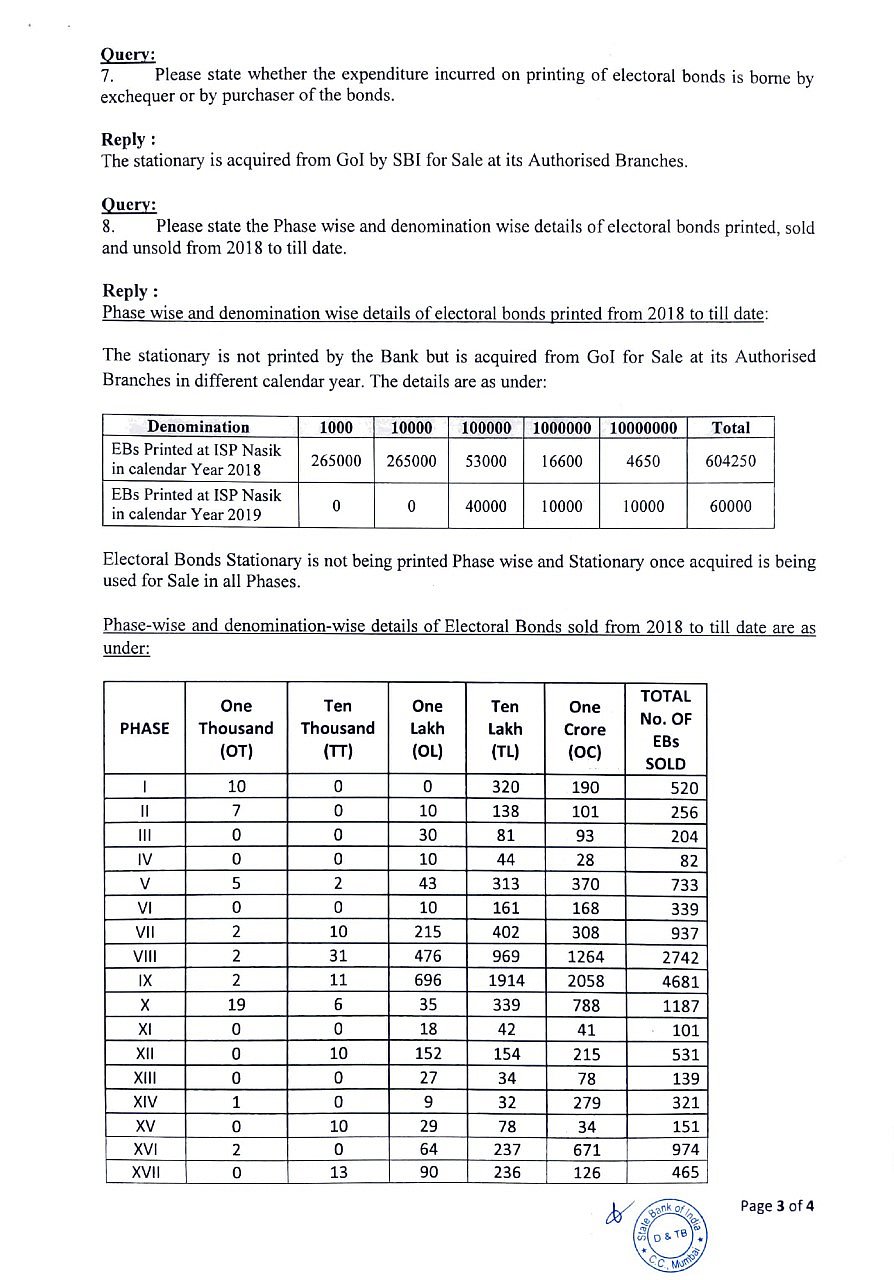

Electoral bonds are interest-free financial instruments used to donate money anonymously to political parties and are sold four times a year: in January, April, July, and October. The bonds are sold in multiples of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh, and Rs 1 crore. Electoral bonds of Rs 1 crore in value are most frequently used.

The scheme was first introduced in 2018 amidst huge political opposition and the anonymity provided to donors has been a major bone of contention ever since. The government had argued, and continues to do so, that the scheme ‘improves transparency’.

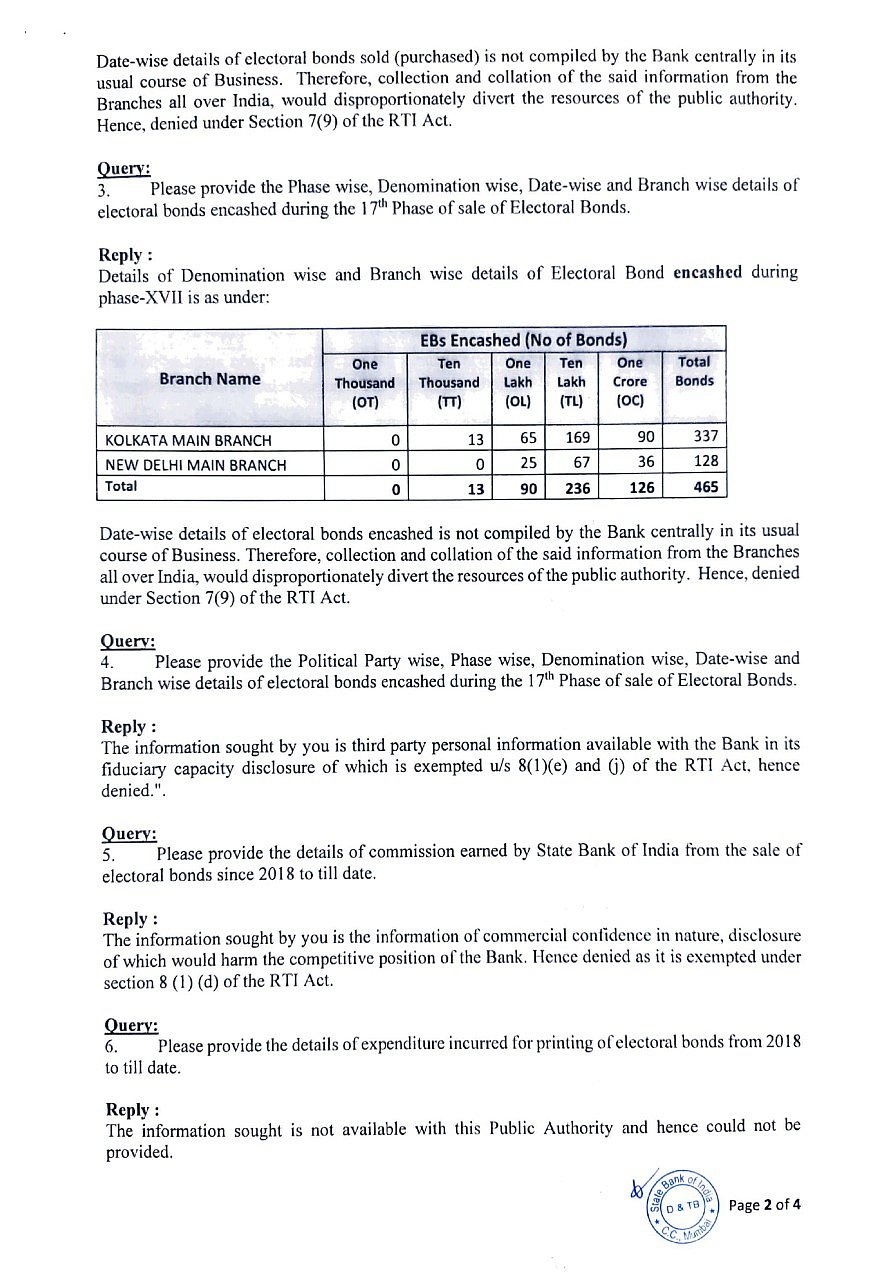

This is not the only data that SBI has refused to reveal. Citing the same section of the RTI Act, it denied date-wise details of electoral bonds encashed by the beneficiaries, saying that compiling this data too “would disproportionately divert the resources of the public authority”.

Incidentally, electoral bonds are sold in limited branches of SBI and only for 10 days every quarter, with every branch likely to be maintaining details of bonds sold per day.

Former Central Information Commissioner Professor M Sridhar Acharyulu said that the SBI was interpreting Section 7(9) of the RTI Act incorrectly. “Information can only be denied using an exception and Section 7(9) is not an exception. It is a facilitating section. Authorities are under statutory obligation to compile and categorise their own activities and keep it ready for disclosure,” said Acharyulu.

The Public Records Act, 1993, mandates a public authority to maintain necessary information and the RTI Act mandates that such an authority disclose this information under Section 4(1)(b) when required to do so.

“The RTI Act states ‘disproportionately divert’, which means only if crores of rupees have to be diverted to collate any information. The sale happens in their own branches in their own offices, so all they have to do is send an email. This is factually incorrect for the Public Information Officer to claim exception under this,” underscored Acharyulu.

In his RTI application, Kanhaiya Kumar had asked SBI to provide the details of commission earned by it from the sale of electoral bonds since 2018. But the CPIO denied the request, stating that it is of commercial confidence in nature, “disclosure of which would harm the competitive position of the Bank. Hence denied as it is exempted under section 8 (1) (d) of the RTI Act”.

With State Bank of India being the only financial institution allowed to sell electoral bonds, neither does it have a ‘competitor’ and nor will the disclosure of this information harm the bank’s ‘competitive’ position.

Earlier this year, SBI had revealed in response to an RTI application filed by another activist, Lokesh Batra, that the total commission payable by the government to the bank for 15 phases of bond sales amounted to Rs 4.35 crore. While Rs 4.10 crore of this had been paid, commission for 14th and 15th phases had not been paid till March 2021, it had said. There is no information available yet on the commission paid for the 16th and 17th phases.

The 14th and 15th phases of the sale of the bonds were in the run-up to the Assembly elections in Tamil Nadu, West Bengal, Puducherry, Assam and Kerala.

Slamming the SBI’s CPIO, Acharyulu said the CPIO is under obligation to justify the denial of information. “A mere mention of an exemption is not

enough. Factually, this statement is incorrect as SBI enjoys monopoly and there is no commerce or confidentiality involved. The CPIO should be punished for abusing the RTI Act,” underscored the former information commissioner.

“This attempt to camouflage information shows anti-transparency attitudes of administrators. Information, especially with reference to finances of political parties, should not be hidden as it gives rise to natural suspicion,” added Acharyulu.

Rs 150.5 crore worth of electoral bonds sold in July

According to a response to another query in the RTI application, during the 17th phase sale which occurred after the West Bengal state elections, the Kolkata branch of State Bank of India (SBI) recorded the highest sales of electoral bonds. Between July 1 and July 10, 2021, bonds worth Rs 97.31 crore were sold by this branch and electoral bonds worth Rs 150.5 crore were sold and encashed during this phase.

Since the inception of the scheme until now, 14,363 electoral bonds worth Rs 7,380.64 crore have been sold.

SBI disclosed to the Bihar-based activist that in the April phase of bond sales, the highest amount of electoral bonds were sold at its Kolkata branch (Rs 176.1 crore), followed by New Delhi branch (Rs 167.5 crore) and Chennai branch (Rs 141.5 crore), but the highest amount was encashed in New Delhi.

Of the 974 electoral bonds worth Rs 695.34 crore that were sold, bonds worth Rs 351 crore was encashed at the New Delhi branch of SBI, followed by Bhubaneshwar (Rs 116 crore), Chennai (Rs 106 crore), Hyderabad (Rs 63.5 crore), Kolkata (Rs 55 crore) and Mumbai (Rs 3.8 crore).

On July 21, in response to a query in Parliament by Trinamool Congress MP Santanu Sen on the details of the sale of the bonds during the 15th and 16th phase, Minister of State for Finance Pankaj Chaudhary said the govt needed more time to furnish the data. The same data has, however, been furnished in response to RTI queries by the activist.

BJP gets bulk of electoral bonds sold

In 2019-20, BJP got Rs 2,555 crore of the electoral bonds worth Rs 3,355 crore, 76% of the electoral bonds sold in the financial year. During the previous financial year, BJP had received Rs 1,450 crore through the electoral bonds. The BJP alone has received 68% of the electoral bonds sold since inception till March 2020.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines