Exclusive: Modi Government cheats states of their due, engages in smash & grab

Even as the Union Government is plotting to deny states their legitimate share of tax revenue, available figures suggest the heist has been carried out without a squeak from the states

Media reports suggest that in its memorandum to the 15th Finance Commission, the Union Government has sought a substantial reduction in the devolution of tax share to the states from the divisible tax pool.

While the Union government has been coy with the numbers, estimates showed that if the Finance Commission were to agree to the Centre’s list of demands, the devolution would come down to 33-34 per cent from the current 42 per cent.

This is the smash part of the heist.

The ‘substantive’ demands have been cloaked with sanctimony to create the false impression that the 14th Finance Commission’s (FC) recommendations had made the Union Government a pauper, increased its burden and drained its kitty. Facts tell a different story.

The 14th Finance Commission’s recommendations, implemented in 2015-16, had indeed increased the states’ share from 32 per cent to 42 per cent of the amount in the divisible pool.

The reasoning for this increase is also well explained by the 14th Finance Commission in its report and this constitutional obligation has been flaunted by the Government as its munificence and magnanimity and part of its belief in co-operative federalism. This of course was making a virtue out of necessity.

But is the demand for increasing the Union Government’s share of tax revenue by effectively slashing the states’ share fair or justified? Even a cursory examination of figures available in the public domain show how truth is stretched.

They actually suggest, if anything, that states have been the real losers. BJP-ruled states dare not raise their voice and the opposition-ruled states do not seem to have caught on to the heist.

A look at the devolution of taxes in the last five years available in the published Indian Budget figures of the period (the actual budget figures for the period from 2015-16 to 2017-18, the revised budget figure for 2018-19 and budget estimates for 2019-20) throw some light.

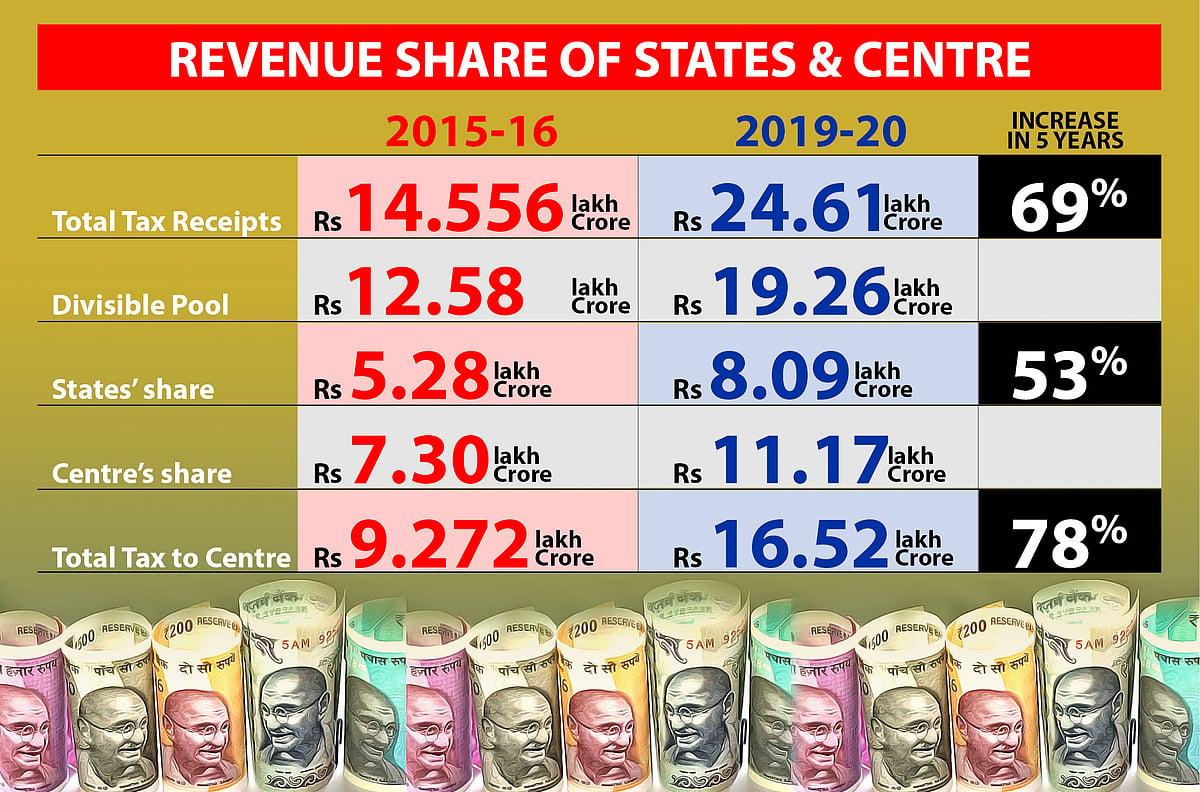

In the 2015-2016 Union budget, out of the total receipts of Rs.14.556 lakh crore, Rs. 12.580 lakh crore or 86.4 per cent was set aside for the divisible pool and 42 per cent of which (Rs. 5.284 lakh crore) was shared among States and the rest went to the Union Government (See Table).

In the 2019-20 Budget, the figures are ₹24.612 lakh crore, ₹19.265 lakh crores, and 78.3 per cent respectively—out of which ₹8.091 lakh crores is earmarked as share of the states.

What it means is that when total tax receipts in the Union Budget increased in the last five years by 69 per cent (from ₹14.556 lakh crore in 2015-16 to ₹24.612 lakh crore in 2019-20), the devolution to the states increased by only 53 per cent (from ₹5.283 lakh crore in 2015-16 to ₹8.091 lakh crores in 2019-20). Same time, the total share to Union Government increased by 78 per cent (from ₹9.272 lakh crore in 2015-16 to ₹16.521 lakh crores in 2019-20)!

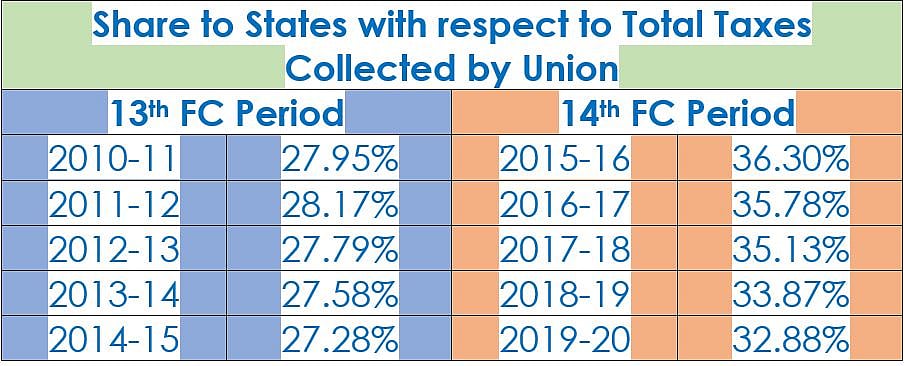

This also means that during 2015-16, the states’ share of Rs.5.283 lakh crore was 36.30 per cent of the total tax receipts of Rs.14.556 lakh crores of that year.

But in the 2019-20 budget, this has been reduced to 32.88 per cent. This ratio is likely to go down further when the effect of the recent corporate tax cut hits the divisible pool, which will be disclosed only when the Government presents the revised budget for this year in the next budget.

The table above shows how Dr Manmohan Singh’s UPA-2 government treated the divisible pool when the share of the states was 32 per cent.

The share of the states in 2010-11 at 27.95 per cent, was marginally reduced to 27.58 per cent in 2013-14, when UPA demitted office. The last year of 13th FC was NDA’s first year in power, when the share was further reduced to 27.28 per cent in 2014-15.

In real terms, what the states lost, or what the Union government grabbed by this reduction from 36.30 per cent to 32.88 per cent of the total taxes (i.e. the 3.42 per cent difference) is a substantial Rs. 84,173 crore, which would have otherwise gone to the states.

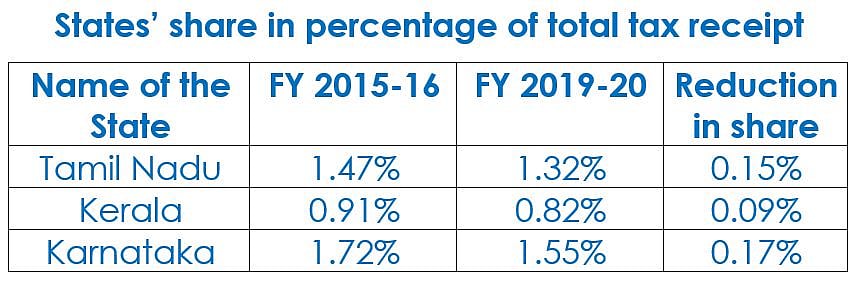

Since the three of the southern states are tax positive in as much as they receive less than what they generate in taxes for the union, let us look how the reduction in these states’ share between 2015-16 and 2019-20, has affected their treasuries.

If the divisible pool share had been maintained at the same proportion of total tax revenue as in 2015-16, Tamil Nadu would have received, 0.15% excess of ₹ 24.612 lakh crores, total tax receipts in 2019-20, ie, ₹ 3,692 Crore more. Similarly, Kerala would also have received an additional ₹ 2,215 crore (0.09% excess) and Karnataka ₹4,184 crore (0.17% excess) more.

What method of painless tooth extraction did the Union Government adopt to mulct this huge amount from the states?

A forensic enquiry also shows how Excise Duty on petroleum products, especially fuel, was cleverly tweaked by the Modi Government to deny the states a bigger slice of the pie while usurping for itself the lion’s share.

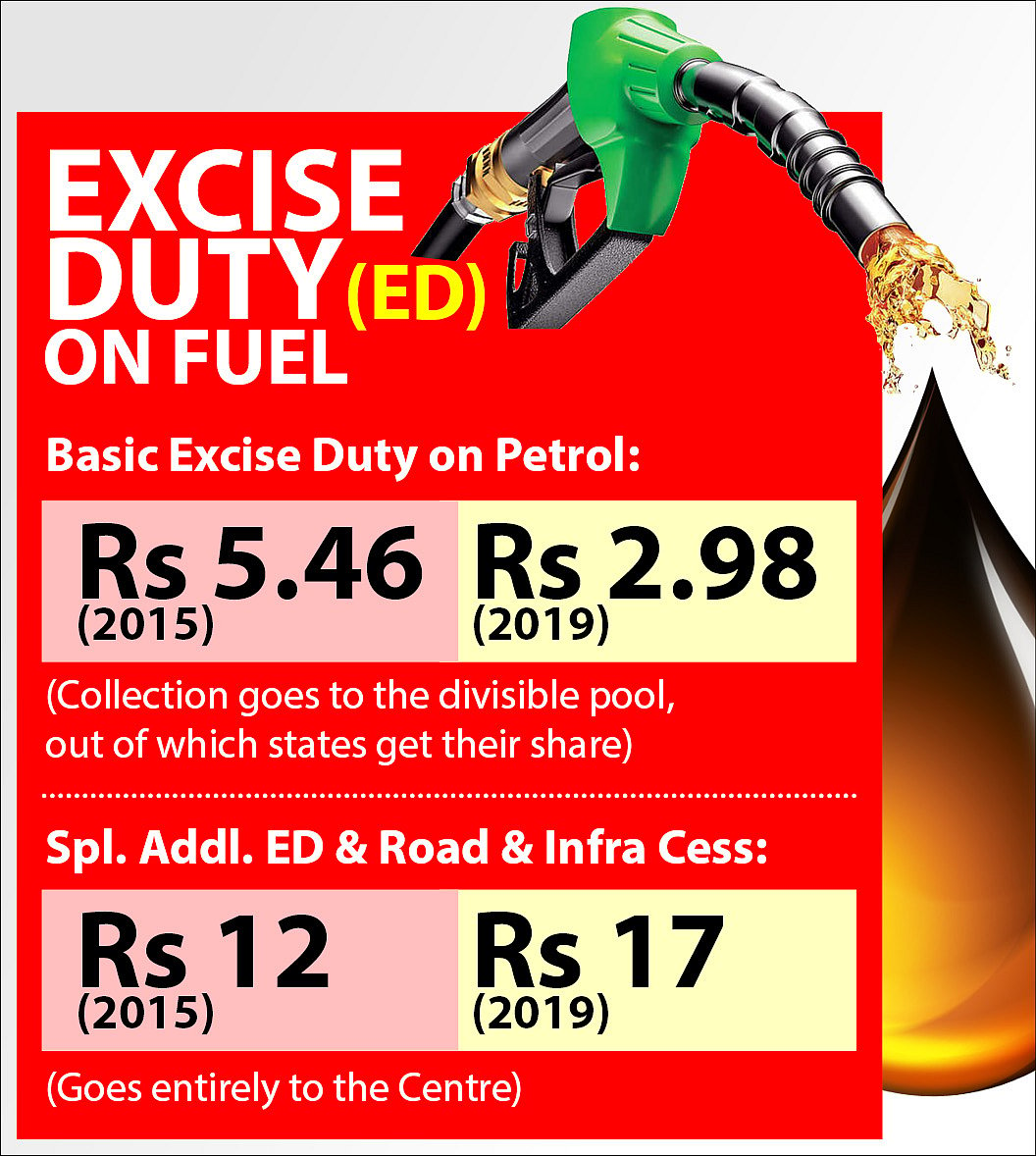

Excise duty on fuel has three distinct components, viz., basic excise duty, special additional excise duty, and additional excise duty (road and infrastructure cess).

Out of this, only the basic excise duty is included in the divisible pool and the other two are categorised as surcharge/cess, which go exclusively to the Union Government.

A sleight of hand – hiking the last two components and spiking the first – seem to have helped Modi Government to expropriate a larger share than prescribed by the 14th FC and reduce the states’ share.

The total excise duty on Petrol on 1 March 2015 was Rs. 17.46 per litre which has now gone up to ₹19.98 per litre. But the ₹5.46 basic excise duty on petrol (31.3% of total excise duty) now stands reduced to ₹ 2.98 (just about 14.9% of the total excise duty).

During this same period, however, while the basic duty on diesel which was ₹4.26 per litre has indeed gone up to ₹4.83 per litre, the other two components together, the cess, have been hiked from ₹ 6 per litre to ₹11 per litre, the full benefit of which going to the Union Government.

It was expropriation or misappropriation done with remarkable stealth and not so much as smash-and-grab.

Further drilling down into the data from Petroleum Planning and Analysis Cell and Central Government budgets will provide a clearer picture of the heist.

In 2014-15, the basic excise duty on fuel was 59 per cent of the total excise duty of ₹99,184 crores collected. In this financial year (2019-20), it has gone down to just 39 per cent of the total excise duty collected, i.e. ₹2,77,065 crores (projected in the 2019-20 budget).

The Modi government has a big enough mandate to ride roughshod over the Opposition in Parliament. Many of the states are ruled by the BJP or NDA constituents, which will not raise their voice against the expropriations underway.

Those with other parties in power, do not seem to be aware of the shifting sand under their feet.

With the mounting NPAs, tanking economy, and mindless expenditures that the government is indulging in on the pretext of reviving the economy, even this smash-and-grab will soon prove insufficient.

And then it will be on to scraping the bottom of the barrel for all of us.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines

Published: 25 Nov 2019, 7:00 AM