RBI's Monetary Policy Statement 2023 Highlights

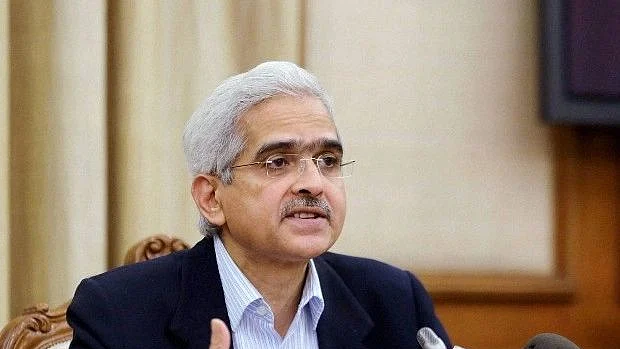

RBI Governor Shaktikanta Das presented the Monetary Policy Statement 2023 on Wednesday. “The global economic outlook does not look as grim now as it was a while ago,” said Das during his address.

Reserve Bank of India (RBI) Governor Shaktikanta Das presented the Monetary Policy Statement 2023 on Wednesday morning.

Significantly, the RBI hiked the repo rate, the rate at which it lends short-term funds to banks, by 25 bps while retaining its stance of withdrawing accommodation.

“The global economic outlook does not look as grim now as it was a while ago,” Das said during his address. “Though inflation still remains well above the target in some major economies,” he added.

Following are the highlights of RBI's monetary policy statement:

• Hikes benchmark lending rate by 25 basis points to 6.50 per cent

• Projects 6.4 pc economic growth for 2023-24, lower than 7 pc this fiscal

• Inflation to come down to 5.3 pc in 2023-24, from average of 6.5 pc this fiscal

• Inflation outlook clouded by protracted geopolitical tensions, rising commodity prices

• Indian economy resilient; higher rabi acreage, robust credit expansion, thrust on capex in Budget 2023-24 to support growth

• Current account deficit to moderate in Oct-March, from 3.3 pc in April-Sept this fiscal

• Foreign exchange reserves at USD 576.8 billion as on January 27, 2023, covers 9.4 months of projected imports for 2022-23

• Indian Rupee remained one of the least volatile currencies among its Asian peers in 2022 and this year

• All inbound travellers to India will be allowed to use UPI for their merchant payments

• Pilot for QR Code based Coin Vending Machine (QCVM) to be launched in 12 cities

• The next meeting of monetary policy committee scheduled for April 3-6.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines