Depreciation of the Rupee is the bullet the Modi Government must bite now

The faux Rupee nationalism has adversely impacted exports. The depreciation will undoubtedly hit people getting fixed returns from securities. But the bitter pill is the only way out of the crisis

In the first part of this essay on the Indian economy, we saw that falling consumption due to job losses and lost incomes due to the pandemic mean that internal demand is insufficient to revive the economy from its slump. Also, as Govt. borrowings touch 90% of the GDP, scope for stepping up Govt. expenditure for investment led growth is limited.

Here is the link to the first part of the essay:

India's credit rating is currently at the lowest investment grade, and any slip up will turn its credit into junk, which will be hugely disruptive of international capital & trade flows. With fiscal deficit [Union plus states] already at 11.5% of GDP, the Govt finances are already precarious and the margin for error doesn't exist.

In this doom and gloom, the only bright spot is the export market. Global GDP has not been as badly hit as that of India by this pandemic, and is recovering much more robustly than India's economy, and we could tap the overseas markets to help us grow out of the slump over the next 2/3 years provided we configure our economy right.

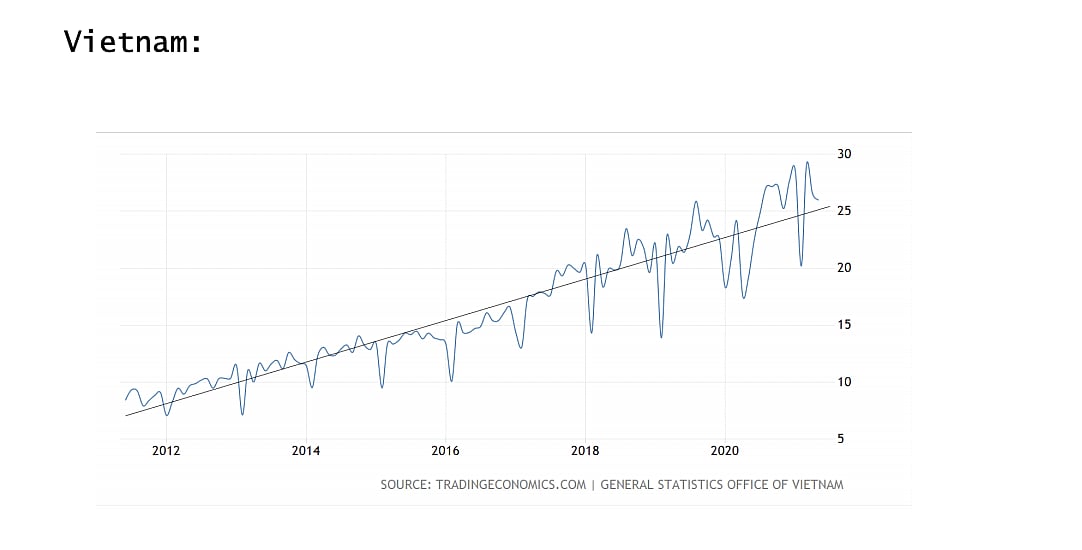

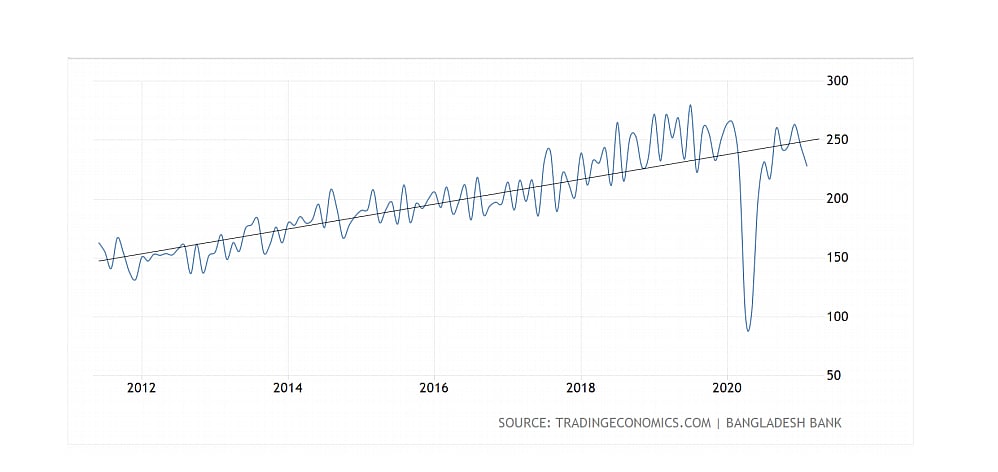

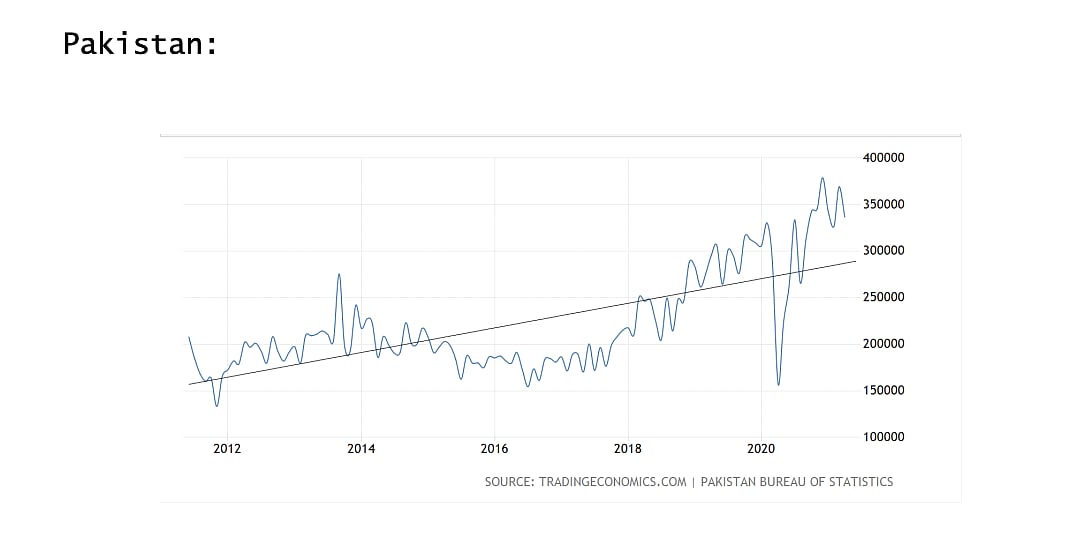

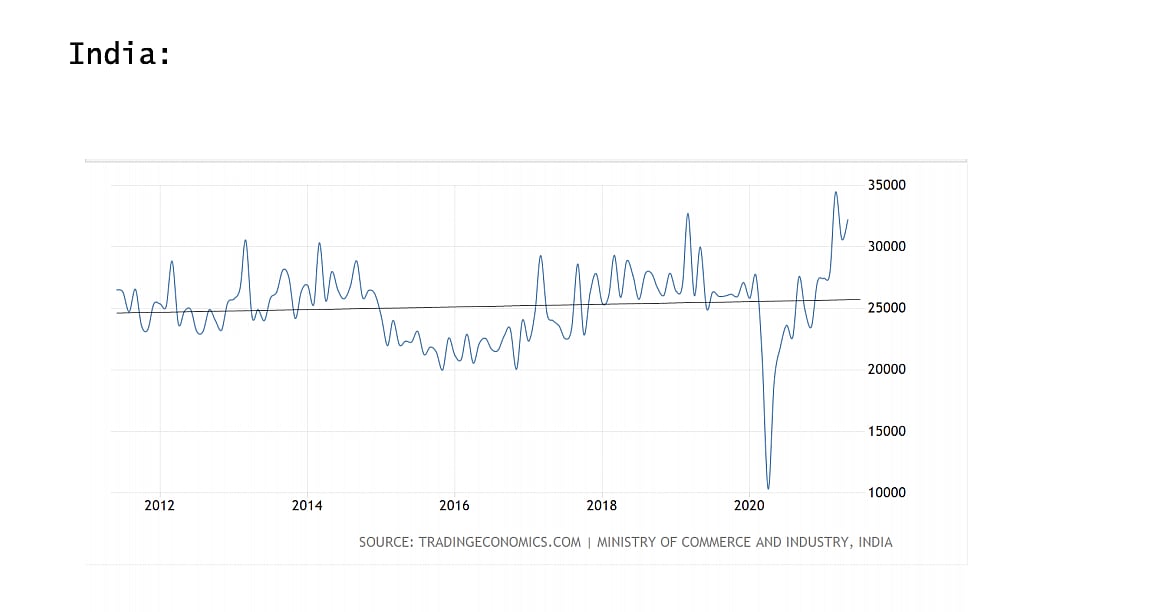

EXPORT GROWTH: India's export growth over the preceding decade has been abysmal compared to our competitors like Vietnam, Bangladesh, and Pakistan, as the straight line in the following graphs would show:

Bangladesh:

The straight line through the graphs shows trend in growth. Clearly, in terms of relative growth, India comes off rather poorly with growth in exports being near zero.

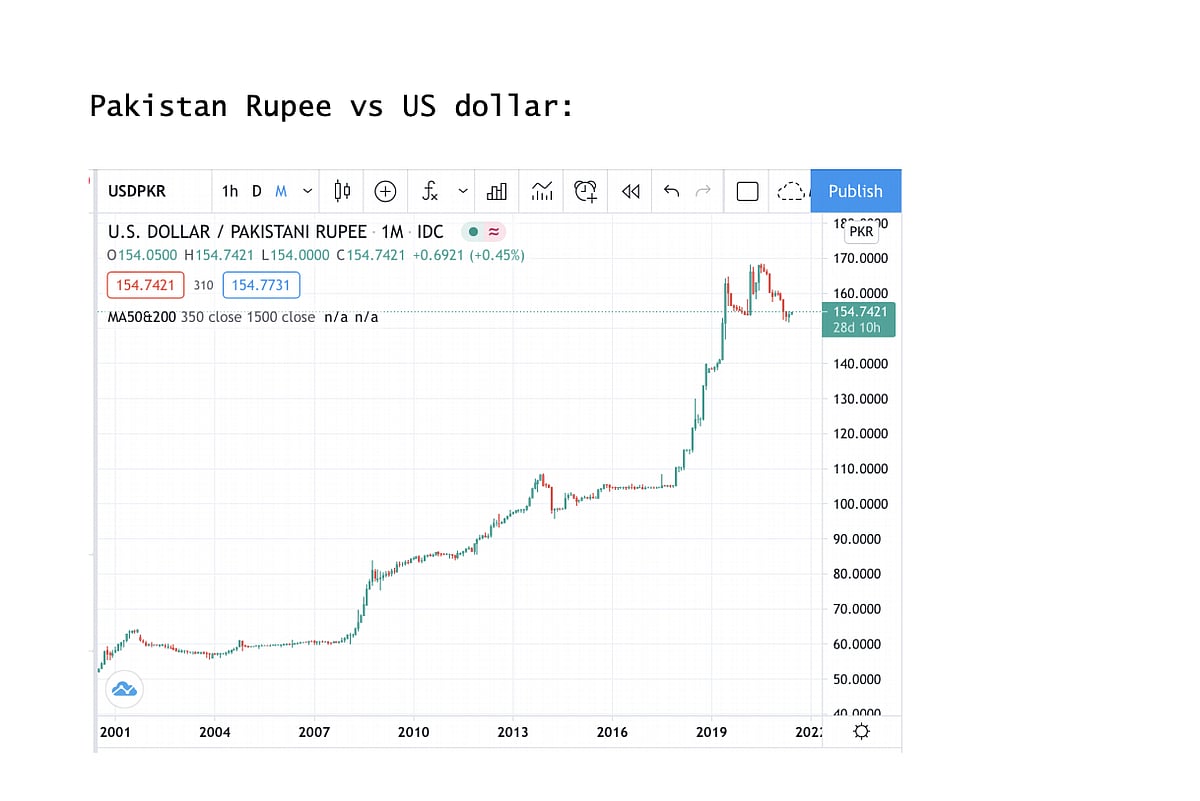

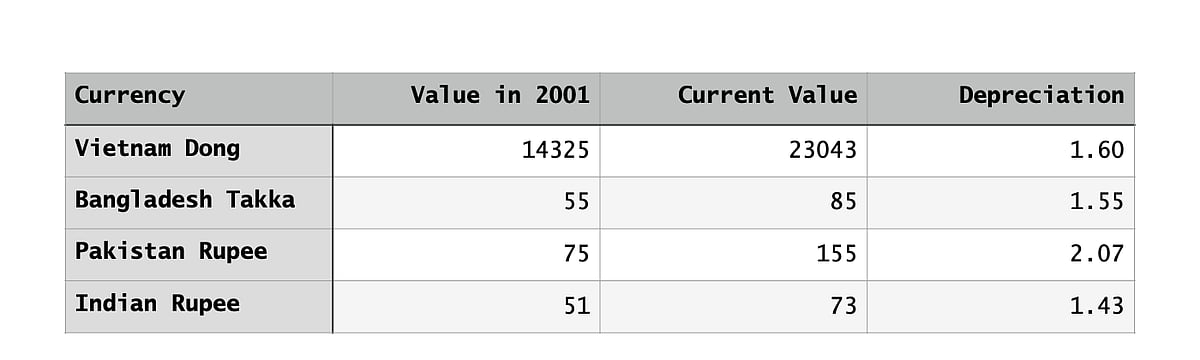

Merchandise exports, especially of low & moderately value added goods are function of price; and the stability of that price. Let us therefore look at the currency values of these four competitors over the last two decades.

The following table summarises the movement of the four currencies against the Dollar over the last two decades:

As can be seen clearly from the chart, our competitors have kept their currencies competitively priced to maintain the profitability of their export sector, while we have allowed the INR to appreciate [relatively] much more than our competitors, negatively impacting the profitability of our exports and their growth.

In fact, if we take the last seven years under Modi from 2014, the faux Rupee nationalism has resulted in a grossly inflated INR compared to our competitors and the growth in exports has tanked to zero. That an artificially strong Rupee hurts exports is not rocket science. But under Modi, faux nationalism trumps economic sense.

WHY DOES THE INDIAN RUPEE GET OVER VALUED?: Our system for managing our external reserves is a carry-over from our past, when there was a desperate need to shore up our external reserves by begging and borrowing abroad. As India liberalised capital flows post 90/91, and opened up its economy to foreign investment, foreign capital flooded in and our external reserves rose handsomely. So much so that there was loose talk of full convertibility in the near future.

However, the fact is that we have consistently run up a Current Account Deficit of about 2% GDP since independence, and there has never ever been a trade surplus in our trade balance. Hence the talk of our "reserves" is pure fiction. They are really "cash-in-hand" created by borrowing money abroad, be it from NRIs or foreign portfolio investors.

Except for real FDI, [distinct from Modi's fake statistics,] all of our foreign inflows are on repatriable basis & for the economy as a whole, they represent debt to be repaid from future surpluses.

As we have seen since March 2020, whenever foreign money through FPI flow into the economy, the external value of the INR shoots up despite RBI's valiant efforts to sanitise the dollar inflows. These excessive Dollar flows impact the export sectors profitability negatively and hamper the growth of export volumes.

In short, the very fact of borrowing to shore up our reserves, creates an overvaluation of the INR that hurts exports and results in the underlying trade deficit going uncorrected. We have to disrupt this vicious loop-back in order to prevent our borrowings from bloating the external value of the INR.

HOW ARE EXPORTS AN OPORTUNITY?: Global trade is recovering much faster than Indian economy because we have bungled the management of the pandemic. We can convert this into an opportunity by adjusting the external value of the INR by about 20% to correct the over-valuation that has crept into the Rupee over the last decade. This will have a cascading effect on the economy, priming it up for faster growth as briefly outlined below.

1. The 20% depreciation of the INR will hugely incentivize exports of cereals, cotton, cotton & synthetic textiles, engineering goods, automobiles, and software services exports by making them more profitable. All these are labour intensive sectors. Provided we maintain a consistent exchange rate policy that prevents capital flows from bloating the Rupee, there is no reason why exports cannot grow by 15% to 20% annually.

2. The software services sector, highly labour intensive as it is, with fabulous value addition compared with manufacturing, and being less resource intensive to boot, is already adequately profitable. With Rupee depreciation, its profitability will increase. It may therefore be in order to claw back the windfall profits to the sector from Rupee depreciation by removing all tax exemptions & winding up MAT, and putting the sector under a normal tax regime for exports that asks for 15% of taxable profits as taxes.

3. The Rupee depreciation can be used to wind up most of the protectionist import duties levied on commodities like steel, cement etc as the depreciation itself will provide sufficient protection from imports. This should be accompanied by a firm commitment to use the exchange value of the INR as a way of ensuring export profitability & protection from predatory imports across all sectors on a continuing and sustained basis.

4. Modi has piled up import duties on consumer goods. These can be rolled back as the exchange value will provide protection from imports. Govt. should also institute system wide studies to ensure that no duty inversion occurs in manufacturing. Every such inversion must be removed by adjusting the external value of the INR within reasonable parameters.

GOVT DEBT & SOCIAL SPENDING

1. An indirect impact of the 20% INR depreciation will be to lower the real value of Govt's internal debt by about 18%, given that such debt is now 90% of GDP. This happens because the nominal value of the GDP goes up as result of the depreciated INR, while the nominal value of existing stock of debt remains constant. The effect is not instantaneous. The growth in nominal GDP takes 1 to 2 years to infuse into the economy. Nevertheless, the net result is that, all other things remaining the same, outstanding Govt debt will be pared down from 90% of GDP to about 74% of GDP in about two years. This diminution in the real value of the outstanding debt creates the fiscal room for additional social spending that is needed to boost the economy.

2. The additional fiscal room created will fill the 10% hole in the fiscal balance created by the pandemic, and still leave room for a fiscal stimulus of about 6% of GDP without taking into account the savings to come from ending export subsidies etc. This can be spread over the next two years.

3. The social spending should be directed entirely at the rural sector of the economy by combining MNREGA with rural housing, rural road construction, rural water supply schemes, rural sanitation and rural primary health centers. These offer quantum jumps in productivity, cost little, are labour intensive, and create rural semi-skilled jobs for wage earners, whose entire income is largely spent immediately. This massive investment in rural hinterland will help reignite the engines of growth far better than spending money on long gestation, highly capital intensive projects like rail corridors and bullet trains.

4. The 20% depreciation in the INR will of course hurt the holders of fixed income securities like banks, pension funds, insurance companies, and some fixed deposit holders. They have had a party since since 2014, benefitting artificially from huge capital gains on fixed debt securities that were generated by an artificially bloated Rupee. Some of these gains will unwind and help dissolve a part of the Govt stock of outstanding debt.

IS THERE ANY OTHER WAY ?

We have reached the end of the road as far as borrowing internally to finance growth is concerned. We have to pare down the real value of debt in the economy to a reasonable level and at the same time, create an opportunity for future growth through export growth, which we have neglected for far too long.

Part of the surplus that is created by diminishing the existing stock of Govt debt, can be channeled into rural areas for income support to the poor as well as investing in rural infrastructure that is of immediate relevance to the rural citizens. That this can be done by combining ruling infrastructure and MNREGA is a huge advantage.

If we fail to be pro-active in managing the crisis, we will be dragged into the quagmire not unlike the one that chronically afflicts Latin American economies of too much debt crimping growth leading to a loss of confidence in local currency. And then a similar but harsher fiscal discipline will be imposed on us by external creditors. We are already at the lowest rung in the investment grade below which lies the abyss of junk where credit costs shoot up sky-high.

To avoid the trap, the Government should proactively swallow the bitter pill of a currency depreciation immediately. From Narendra Modi's point of view, the medicine taken now will avoid the opprobrium and stigma attached to an externally mandated structural adjustment program. Furthermore, bitter pill taken now is likely to result in a growing economy by 2024 election time, giving Modi's prospects a boost.

So, it is for him to bite the bullet and embrace real reform now. We have done this before; and successfully. The template is available. It can be tweaked and used to resolve the current crisis.

( The writer is a Consultant and an Independent Trader in financial markets. Views are personal)

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines