RBI’s shift to neutral stance signals potential rate cut as inflation eases

Several factors could derail the inflation trajectory as the MPC keeps its cards on a rate cut close to its chest

For the tenth consecutive meeting, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) opted to maintain the status quo on interest rates. This decision, while expected, comes with a significant change in the central bank's stance.

Shifting from a ‘withdrawal of accommodation’ to a ‘neutral’ stance, the RBI now signals that a rate cut could be on the horizon — provided inflation continues on its downward trajectory.

Inflation tamed?

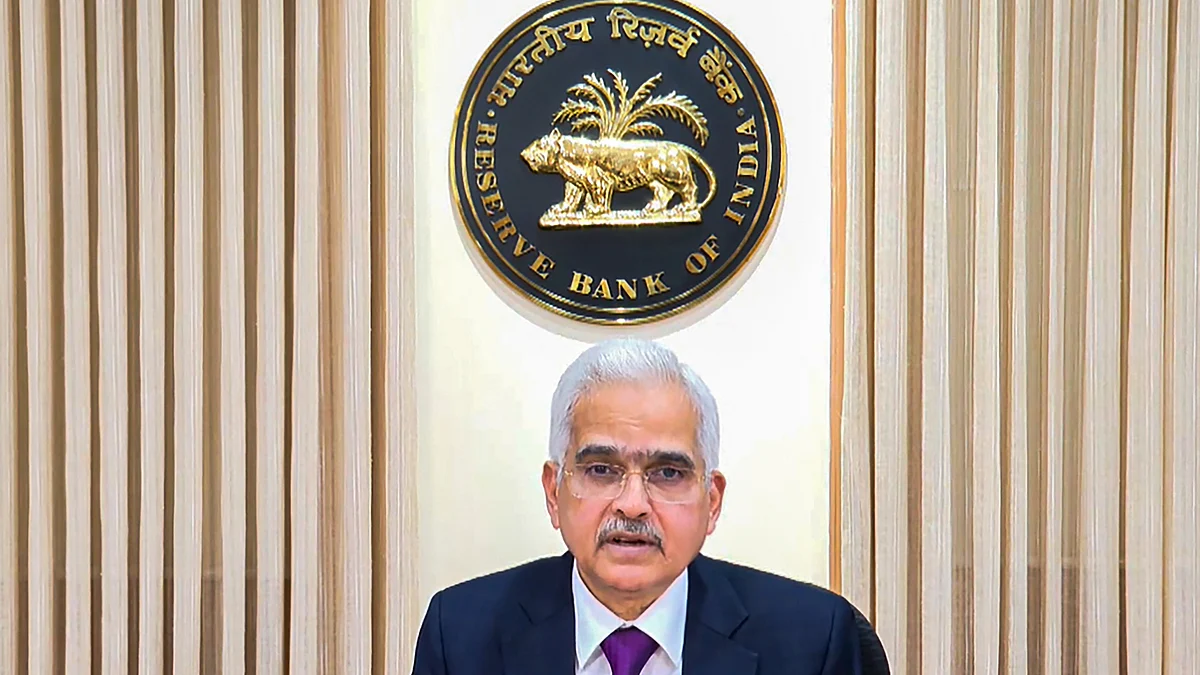

In his statement, RBI governor Shaktikanta Das drew attention to the central bank’s success in stabilising inflation, noting, “The inflation horse has been brought to stable with great difficulty.”

However, he cautioned that vigilance is still necessary to prevent inflation from spiralling out of control once again. This careful choice of words suggests that while the central bank is optimistic, it is not yet ready to ease policy until more stable conditions are confirmed.

The RBI has long maintained that retail inflation must sustainably align with the 4 per cent target before any easing of rates can begin. Though retail inflation is showing signs of cooling, the central bank prefers to adopt a wait-and-watch approach, given the risks that remain.

Key risks to inflation

Several factors could derail the inflation trajectory. The most significant of these is food price volatility, with food products making up nearly 46 per cent of the Consumer Price Index (CPI) basket. Furthermore, geopolitical tensions, such as the ongoing Iran-Israel conflict, can potentially escalate and disrupt crude oil supplies, which would have a cascading effect on overall inflation.

Additionally, rising global commodity prices could trigger a resurgence in core inflation, as companies that previously held back on price hikes may now raise prices, further elevating inflationary pressures.

Economist Radhika Rao from DBS Bank pointed out that core inflation, which excludes food and energy, may rise due to price hikes in sectors such as telecom and gold. Despite this, she expects core inflation to remain below headline CPI inflation in the near term.

While the MPC’s focus has been on curbing inflation, it cannot afford to overlook growth for too long. India’s economy continues to grow below its potential, and high real interest rates are contributing to this slowdown. Employment figures also remain less than encouraging, underscoring the need for the central bank to eventually prioritise growth.

The upcoming inflation data for September and October will play a crucial role in shaping the RBI’s next move. If inflation remains contained and there are no major surprises, the December meeting could mark the start of a rate-cutting cycle.

Market reactions

The RBI’s decision to maintain its policy rate has generated varied reactions from industry experts. Upasna Bhardwaj, chief economist at Kotak Mahindra Bank, remarked that the RBI’s stance aligns with expectations and predicted the onset of rate cuts by December, albeit with limited scope for significant easing in the short term.

Similarly, Anu Aggarwal, head of corporate banking at Kotak Mahindra Bank, highlighted the importance of the central bank’s flexibility in navigating evolving economic conditions.

While a rate cut would have been welcomed by sectors like real estate—boosting homebuyer sentiment and reducing borrowing costs—the neutral stance still indicates an impending shift in policy. The real estate market, already buoyed by a downward inflation trend, is likely to maintain its momentum, with any future rate cuts further improving housing affordability and spurring growth.

A rate cut in December?

As inflationary pressures subside, the stage appears set for the RBI to consider rate cuts in the near future. While caution is warranted due to the aforementioned risks, the gradual easing of inflationary pressures since late 2023 points to a favourable environment for the central bank to eventually adopt a more accommodative stance.

This, in turn, could invigorate sectors like real estate and provide a broader economic boost as borrowing costs come down. All eyes will be on the upcoming inflation data and the RBI’s December meeting for clearer indications of where interest rates are headed.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines