CMIE slashes GDP growth estimate post-note ban to 6% for 2016-17

Forecasting long-term damage to the economy to be greater than recent post-demonetisation estimates, the Centre for Monitoring Indian Economy says next 5 years to also see low growth of 6%

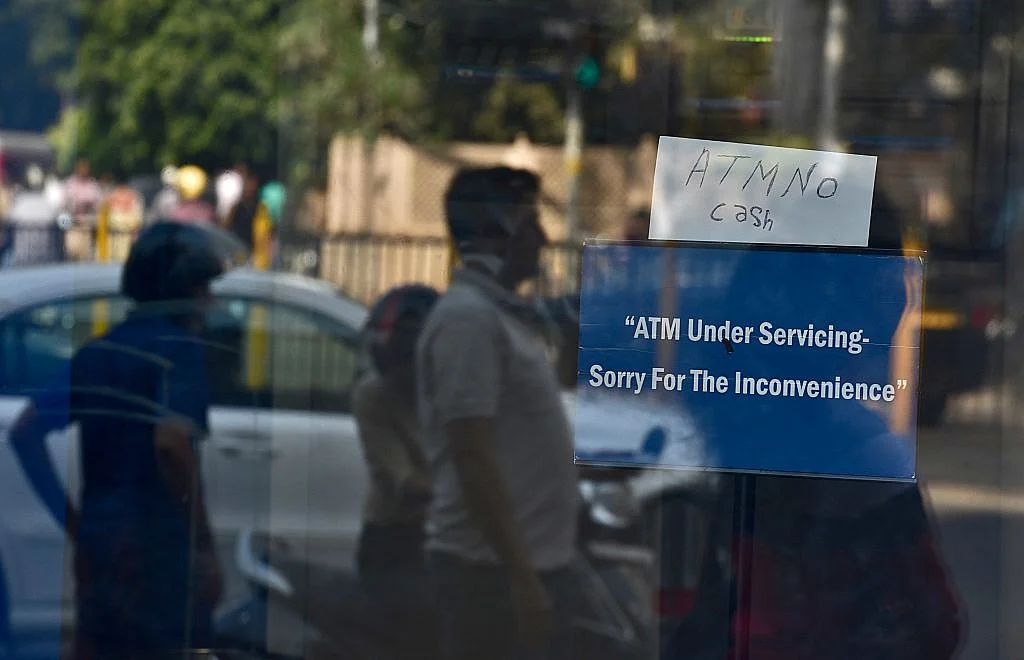

The demonetisation shock seems to have rattled the Indian economy hard with the Centre for Monitoring Indian Economy (CMIE) paring the real GDP growth to 6% in 2016-17. Before the decision of the Narendra Modi government on November 8 to withdraw 86% of the currency in circulation, the Delhi-based think tank had expected the Indian economy to gradually accelerate its real GDP growth rate from 7.5% to over 8% per annum.

The worse, in fact, is to follow with CMIE forecasting “the long-term damage to be greater” than the damage caused to growth during the current financial year. “We now expect this growth trajectory to shift down to about 6% per annum for the next five years (up to 2020-21). The economy is unlikely to achieve a growth of 7% any time during the coming five years,” says the report by CMIE Managing Director and CEO Mahesh Vyas.

This is completely in contrast to the Narendra Modi government’s posturing that fears on demonetisation affecting the GDP are unfounded. Former Prime Minister Dr Manmohan Singh had recently said at the Congress party’s ‘Jan Vedna’ conclave that the worse was yet to come, squarely dismissing the “hollow” claims of PM Modi’s “propaganda” that things were looking up.

The worse, in fact, is to follow with CMIE forecasting “the long-term damage to be greater” than the damage caused to growth during the current financial year. “We now expect this growth trajectory to shift down to about 6% per annum for the next five years (up to 2020-21). The economy is unlikely to achieve a growth of 7% any time during the coming five years,” says the report by CMIE Managing Director and CEO Mahesh Vyas.

While the Reserve Bank of India (RBI) has not yet given an exact number on the amount of currency remonetised so far, the fact is that there is still a huge cash crunch, evidenced by continuing withdrawal limits of ₹24,000 per week per individual. With India being primarily a cash-based economy having over 90% of the transactions in cash, apart from a high cash to GDP ratio at 12%, the sudden and sharp reduction in currency had obviously an immediate and significant impact on consumption expenditure. CMIE says this has led to a corresponding fall in retail prices of perishable commodities, a substantive dislocation of labour and corresponding losses in wages and a break-down of supply chains in many parts. The fall in retail inflation to 3.6% in November and the fall in sales reported by several FMCG companies are early indications of the fall in consumption expenditure, the think tank says.

The fall in consumer demand combined with fall in availability of cash also led to a fall in the demand for labour. This sets in a vicious cycle of low demand for labour and low consumption expenditure. The CMIE expects this low demand to persist till three conditions are met.

- Liquidity is fully restored.

- Confidence in liquidity is fully restored.

- Consumers are yanked out of their equilibrium at lower levels of consumption of non-essential commodities.

However, none of these conditions are expected to be fulfilled in a hurry. The various estimates of restoration of full liquidity range from mid-January to September 2017. And, in the meantime, the ₹2,000 note does not provide liquidity like the decommissioned currencies. “Liquidity is likely to be restored only towards the early second half of 2017. It would take a little longer to gain confidence that the liquidity is for real,” says CMIE.

“Liquidity is likely to be restored only towards the early second half of 2017. It would take a little longer to gain confidence that the liquidity is for real.”Centre for Monitoring Indian Economy

Further, a flight from currency in hand to other asset forms because of a fear of potential loss of liquidity through further demonetisation and a fear of raids or enquiries, could structurally reduce the propensity to spend on consumption goods, the think tank says. As a result, the hit on consumer spending is expected to last much longer than just a few quarters.

Will increased government spending, say, in infrastructure be the way out to buoy growth? The CMIE doesn’t think so: No big changes in government or private spending on infrastructure is expected. The push for infrastructure development has been a constant since the mid-1990s, and this trend is expected to continue without any particular acceleration. “We expect government spending to offset part of the impact of demonetisation through increased spending. But, government has a smaller role and can contain the damage only partially,” the report gloomily forecasts.

Follow us on: Facebook, Twitter, Google News, Instagram

Join our official telegram channel (@nationalherald) and stay updated with the latest headlines